A transatlantic marketplace tale

Are the Germans just stupid, or mean-spirited on top of their stupidity for refusing to save the euro? This is a question being asked all over the world, with politicians such as Barack Obama and British Prime Minister David Cameron only posing it in a slightly more polite form. It has framed the academic debates on the issue, which have been shaped in particular by the Nobel laureates Joseph E. Stiglitz and Paul Krugman. The Economist depicted the global economy as a supertanker in the process of sinking – because Angela Merkel refuses to start the engines by investing money. Have the Germans now become devotees of the end of the world since they had to give up their delusions of world domination?

Are the Germans just stupid, or mean-spirited on top of their stupidity for refusing to save the euro? This is a question being asked all over the world, with politicians such as Barack Obama and British Prime Minister David Cameron only posing it in a slightly more polite form. It has framed the academic debates on the issue, which have been shaped in particular by the Nobel laureates Joseph E. Stiglitz and Paul Krugman. The Economist depicted the global economy as a supertanker in the process of sinking – because Angela Merkel refuses to start the engines by investing money. Have the Germans now become devotees of the end of the world since they had to give up their delusions of world domination?

A metonymic shift

However, the terms of the debate serve only to show that the organization of Europe is so complex that even Nobel-prize-winning economists no longer fully comprehend it. Therefore, let us project the European structures onto the United States. We will call the small state that is going bankrupt because the Germans refuse to save it “Greek-California” or “Greefornia” for short. Granted, Greefornia is bankrupt because it has about eight times as many civil servants per-capita and provides state pensions to workers starting at age 45. The state has horrendous budget defi – cits, and its bonds are worthless because even the fools on Wall Street have fi nally realized, between their sixth and seventh glasses of champagne, that they lent their money to a con man.

So, in our scenario, the governor of Greefornia goes to Washington and requests – nay, demands – financial support. He gets it, even though the US Constitution, like the rules that govern the euro area, expressly prohibit it. After all, what good is a constitution when the stability of a currency is in danger? As the German proverb goes: “Necessity knows no law!” Thus, Greefornia receives a new loan, 27 percent of which is fi nanced by the state of Germamerica, on the condition that Greefornia at least curb the most absurd excesses of its running debts, reduce the number of civil servants, and cut wages and welfare entitlements to approximately the same level as given in Germamerica. The money fl ows, and as expected, the promised reforms are never enacted. Unfortunately, despite the blistering invectives hurled their way, the so-called Wall Street Boys will not deign to fork over cheap loans to Greefornia.

Unlikely tales?

In the meantime, the fi nancial markets have realized that there are practically no businesses in Greefornia anymore except basic utilities. The tomatoes in this sun-drenched land are imported from greenhouses in the Netherlands. Its milk comes from Germamerica, which sends fewer cars and none of the machines for which it is famous to Greefornia, but instead large amounts of food products, including the national specialties feta and ouzo. A peculiar sort of race begins: Every couple of months, the Governor of Greefornia declares that his state will be bankrupt in just a few days, and Washington provides massive sums of money. In the meantime, Greefornia bows to international pressure and begins enforcing its claims to taxes, something it had never done before, even for millionaires, because it simply had no tax and revenue authorities. To this end, authorities begin photographing the state’s landscape, trying to make out swimming pools in order to collect luxury taxes from their owners. The only effect achieved? Soaring sales of military camoufl age nets used to hide the pools. Attempts to sell state-owned enterprises to investors fail because there are no land-registry offices. Approximately 1.5 billion dollars provided by Washington in recent years as aid for the establishment of land-registry offi ces was used instead by Greefornian oligarchs to buy townhouses in London.

Despite all this, some reforms have slowly taken shape. For example, taxes due are now linked to electricity bills. Unlikely tale? Back to reality: Greece’s liquidity situation is worsening despite a massive injection of 120 billion euros in aid. Luckily, the country is part of a joint currency zone – the euro area. Euros, however, are in short supply. But again, Greece is lucky: in this entirely unregulated currency system, it has the right to obtain euros in unlimited amounts from other countries and sell its bonds to the joint central bank. In our scenario: Massive sums are flowing into Greefornia and from there directly to foreign banks. In the meantime, the country is receiving important aid. The presidents of the United States, France, and other countries criticize German-style austerity policies, which they claim are an impediment to growth. Germamerica is being called upon to assume the sovereign debt of all its neighboring countries in unlimited amounts because it got rich exporting ouzo and feta to Greece. Fancy that the President of France in particular has become a ray of hope for growth in Europe. He is lowering the retirement age in France, which was recently raised from 65 to 67 in Germamerica despite vehement protest, from 62 to 60. This move is based on the assumption that the increased sovereign debt this entails would be fi nanced by joint bonds issued by all the countries, which in turn would be guaranteed by Germamerica.

Germamerica’s politicians, who have until now submitted to every demand, although they called for an America-wide fiscal pact so as to limit the growth of sovereign debt, are now coming under pressure from the Nobel laureates. They view the loan guarantees and subsidies provided to Greefornia as much too small given the threat of a global recession. As an alternative, they suggest extending the deposit insurance funds, which protect the savings of Germamerica’s citizens from bank failures, to Greefornia through a banking union. In fact, the crisis in Greefornia has reached another stage entirely. Since taxes were linked to electricity bills, people have simply stopped paying their electricity bills as well, which is exacerbating the crisis faced by public electric utilities.

A real threat

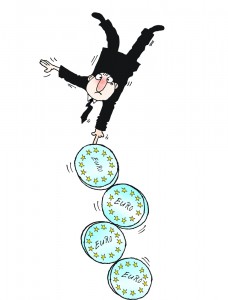

Let us not go further into the gory details of this horrifying role play. However, we recognize some salient lessons: The euro area is structured according to a free-rider principle, and the strictures limiting this principle are being incrementally dismantled: Each country has an incentive to infl ate its own expenditures and debts in the hopes of a bailout from its neighbors. If necessary, the country can obtain practically unlimited credit though overdraft loans in unlimited amounts from other central banks. There is no Washington and no European President.

Europe’s joint institutions are in the hands of small countries, because they operate according to the principle “one country, one vote.” While Europe does have a parliament, it has no real authority vis-à-vis the member states. It is a six-class parliament, in which the citizens of small countries have six times as many votes as those of the largest country. In the leadership committee, Germamerica has one vote out of 16, although it accounts for 27 percent of the euro area’s economic output.

Against this background, it is tragicomic when critics demand that Angela Merkel put her foot down or enact a decisive solution. The objective of European unifi cation was to rein in Germany, the dangerous giant. That has succeeded. One can hardly expect salvation from a colossus in chains, nor can one expect him to remedy defects in institutions on which he has barely any infl uence. Typically, this is achieved through protracted negotiations in which states must be convinced of relinquishing some of their jealously guarded sovereignty in order to craft centralized solutions. Europe is not the United States. The euro area is not the currency system of the United States. Berlin is not Washington, and Greece is not California. The threat of a European bankruptcy, however, is becoming a reality.